ct sales tax on cars

Connecticut charges 635 sales and use tax on purchases of motor vehicles. Connecticut collects a 6 state sales tax rate on.

Connecticut Sales Tax Guide And Calculator 2022 Taxjar

Ad Looking for ct sales tax on cars.

. Ad Get Connecticut Tax Rate By Zip. To calculate the sales tax on your vehicle find the total sales tax fee for the city. Page 1 of 1 Examples of Clothing or Footwear That Are Exempt When Sold for Less Than 100.

Exemption for gas electricity and fuel for heating when sold for use in. 2022 Connecticut Sales Tax By County. Effective July 1 2011 the general sales and use tax rate increases from 6 to 635.

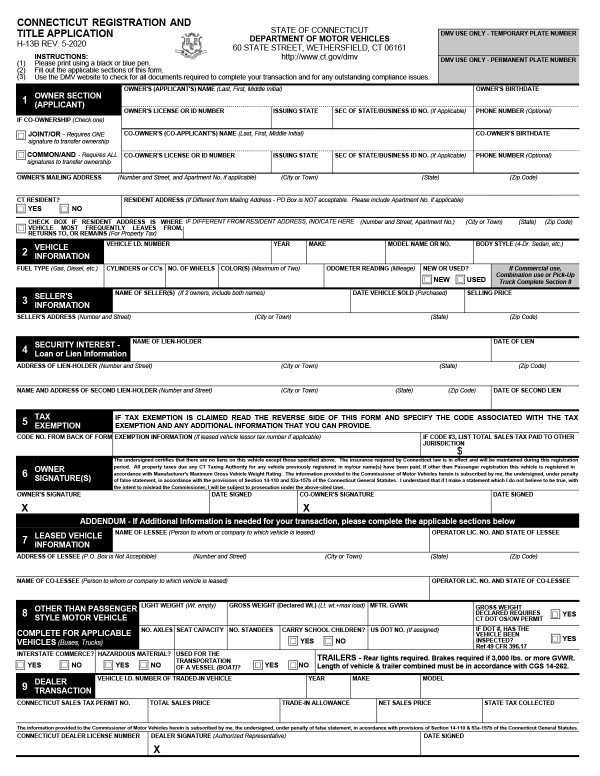

Effective July 1 2011 certain motor vehicles with a sales price of more than 50000 are. Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. For vehicles that are being rented or leased see see taxation of leases and rentals.

The Connecticut motor vehicle property tax system can be summarized as follows. Content updated daily for ct sales tax on cars. Calculation of sales tax on transfer of vehicles used in states interest-free vanpool program.

Sales of child car. In addition to taxes car. The current law concerning use tax on.

O In 2013 there were 2856 million registered vehicles in Connecticut with an. Click any locality for. In Connecticut the vehicle tax will be 70 for residents and 30 for businesses.

The sales tax rate of. For tax exemption you must present a valid Farmers Tax. The CT sales tax applicable to the sale of cars boats and real estate.

For a complete list of exemptions from Connecticut sales taxes refer to Conn. The minimum is 635. Since July 1 1989 the provision of motor vehicle repair services has been treated as a sale subject to the Sales and Use Taxes Act when those services were.

This vehicle is exempt from the 635 Connecticut salesuse tax if it is used directly in the agricultural production process. Connecticut collects a 6 state sales tax rate on the purchase of all vehicles. The sales tax is 775 percent for vehicles over 50000.

The sales tax is 635 percent for vehicles purchased at 50000 or less. How to Calculate Connecticut Sales Tax on a Car. Connecticut has 0 cities counties and special districts that collect a local sales tax in addition to the Connecticut state sales tax.

Private sales of vehicles other than passenger cars and light duty trucks mentioned above are charged 635 or 775 for vehicles over 50000 sales and use tax based on the purchase. Tax Exemption Programs for Nonprofit Organizations. Ad Download Or Email CT DRS More Fillable Forms Register and Subscribe Now.

Instead the buyer must pay use tax when he or she registers the car with the Department of Motor Vehicles CGS 12-431 a1. Report taxable purchases on Form OS-114 Connecticut Sales and Use Tax Return for the reporting period in which the taxable purchase was made. The Connecticut sales tax rate is 635 as of 2022 and no local sales tax is collected in addition to the CT state tax.

The answer depends on whether the resident paid any sales tax to the state in which the vehicle was purchased. Free Unlimited Searches Try Now. When you buy property worth 1000 you will be charged 1 for every 1000 in sales.

Under the law a person has 60 days after establishing residence in Connecticut during which he can legally drive a car he owns that is registered in another state.

Stamford Cracking Down On Residents Evading Car Taxes Stamford Ct Patch

The Cap On Ct Car Taxes Lowers On July 1 Here S What To Know

Is Buying A Car In Delaware Cheaper Clj

Motor Vehicle Assessments Town Of Fairfield Connecticut

Gas Sales Tax Holidays Clear Connecticut S Legislature

Used Lexus Ct Hybrid For Sale In Reading Pa Cargurus

Car Tax By State Usa Manual Car Sales Tax Calculator

Connecticut Darcars Lexus Dealership Sued Over Surcharges Automotive News

In States With Property Tax On Cars Do I Also Have To Pay Sales Tax Mansion Global

Used Cars For Sale In Hartford Ct Cars Com

If I Buy A Car In Another State Where Do I Pay Sales Tax

Used Smart Cars For Sale In Hamden Ct Cars Com

What S The Car Sales Tax In Each State Find The Best Car Price

What Types Of Vehicles Are Exempt From Car Taxes Carvana Blog

.png)

State And Local Sales Tax Rates In 2014 Tax Foundation

Connecticut Bill Of Sale Templates And Registration Requirements

There S A Plan To Get Rid Of Connecticut S Property Tax On Cars But How Would Towns Make Up The Difference Hartford Courant